georgia property tax exemption codes

Tax exempt status of a property is not transferable by a change in ownership between two entities. Municipalities also assess property taxes based upon county-assessed values and rates established by the municipal governing authority.

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

This exemption is available to all taxpayers holding a current exemption with the exception of those receiving the benefit of a 100 reduction in school taxes and will reduce the school tax.

. HOMESTEAD FREEZE EXEMPTION WILL ELIMINATE COUNTY M O. Usually the taxes are collected under a single billing from the county. Exemption of homestead occupied by owner.

The following table describes each of the different homestead exemptions and the deducted amount from the assessed value of the property. County and City Sales Tax ID Codes. Must own and reside on the property on or before January 1st of the effective tax year.

EXEMPTION CODE L13. While the state sets a minimal property tax rate each county and municipality sets its own rate. Homestead Exemption Codes - Schneider Corp.

Basic Exemption extended to 10000. LGS_County_and_City_Sales_Tax_ID_codes_2014pdf 14829 KB LGS_County_and_City_Sales_Tax_ID_codes_2008pdf 552 KB. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes.

Personal property tax exemption for property valued at 750000 or less. GDVS personnel will assist veterans in obtaining the necessary documentation for. Items of personal property used in the home if not held for sale rental or other commercial use all tools and.

Clayton County Tax Commissioner. Sales Taxes In The United States Wikipedia Any Georgia. Georgia exempts a property owner from paying property tax on.

The Understanding Homestead Exemption. C The property exempted by this Code section excluding property exempted by paragraph 1 of subsection a of this Code section shall not be used for the purpose of producing private or. Georgia code provides several thousand local governmental entities the power to impose real estate taxes.

Learn More at AARP. Basic Exemption extended to 7000. 8 rows If a member of the armed forces dies on duty their spouse can be granted a property tax.

Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. You must meet the requirements of Georgia Law for exemption under code section 48-5-41. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description COOPF 0 COOP - Fulton County S1 Regular.

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Coweta County Tax Assessor. Property in Georgia is assessed at 40 of.

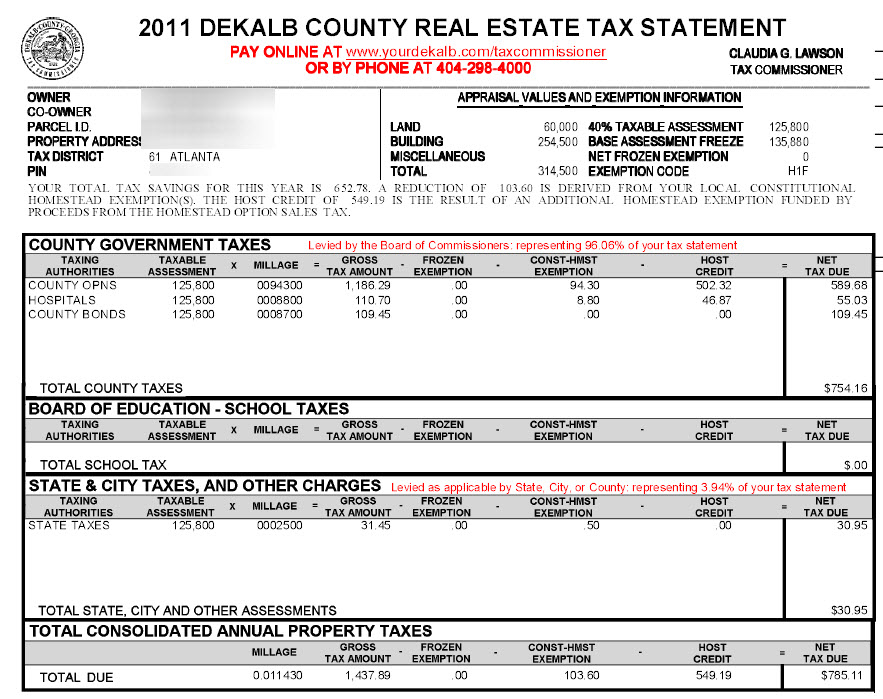

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Homestead Exemption Codes Qpublic

2013 2022 Form Ga Certificate Of Exemption Of Local Hotel Motel Excise Tax Fill Online Printable Fillable Blank Pdffiller

Gsccca Org Pt 61 E Filing Help

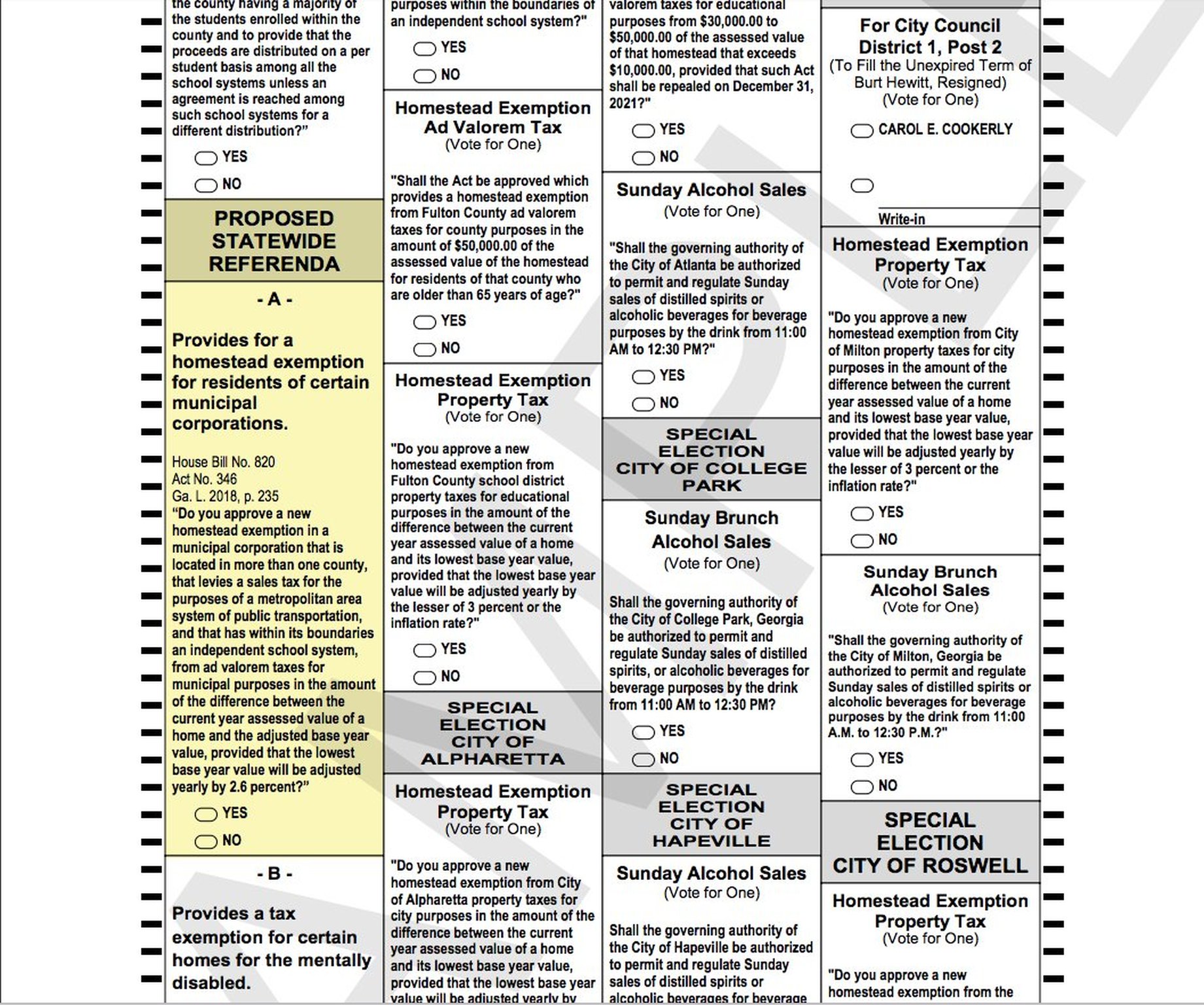

Fulton County Atlanta Tax Proposals On Nov 6 Ballot

Gsccca Org Pt 61 E Filing Help

Georgia Resale Certificate Trivantage

Property Tax Comparison By State For Cross State Businesses

How To Register For A Tax Exempt Id The Home Depot Pro

Pay Taxes Online Peach County Ga Peach County Georgia Peach County Peach County

Property Tax Information Peachtree City Ga Official Website

What Does Property Tax Exempt Code H3 Mean

Georgia Governor Signs Tax Reduction And Reform Act Of 2022 Mauldin Jenkins

Exemptions Henry County Tax Collector Ga

Gsccca Org Pt 61 E Filing Help

About Homestead Exemptions Effingham County Ga

State Of Georgia Certificate Of Exemption Of Local Hotel Motel Excise Tax Fill Out Sign Online Dochub